By Angie Brown, Sales Director, Absence Practice Leader and Lynne Sousa, Leave Management Compliance Counsel

May 6th, 2021

For years, digital transformation has been top of mind for insurance companies. But many carriers were hesitant or slow to commit to tackling a digital transformation project despite all the signs that it was time.

The COVID-19 pandemic has proven to be a catalyst digital transformation. Insurers who kicked the decision down the road are scrambling to get their core systems modernized to meet the demands of today’s remote, digital world. According to Deloitte research, 48% of insurance executives agreed the pandemic showed how unprepared they were to weather this economic storm, with only 25% of respondents agreeing their carrier had a clear vision to maintain operational and financial resilience. [1]

As a result of the pandemic, new data from Aon showed that employers offering voluntary benefits increased 27% during the past enrollment period – significant market growth. In particular, short-term disability participation increased over 15%, reflecting a shifting market opportunity for insurers. [2]

Add to this, the proposed federal Paid Family Leave by the Biden Administration on April 28th. If the proposed leave becomes reality, it likely will have a monumental impact and present an opportunity for insurers. The combined growth in disability insurance and the rising need in absence management provides an emerging market opportunity for insurers to meet the changing demands and needs of their customers. Companies already prepared to administer their customers’ disability insurance and leaves on an integrated basis are well poised to capitalize on the growing market demand.

Unlike the pandemic and the need for digital transformation, the federal leave won’t happen overnight or without warning. While no one could have foreseen the pandemic and the drastic implications it would have on businesses and our very way of life, the rising demand in disability insurance coupled with the new proposed legislation and other state Paid Family Leave laws provide strong indicators of a rapidly changing market that will demand IDAM solutions.

If you don’t have an IDAM solution that supports a disability and absence management offering, the time to act is now!

Increased Demand for Value-added Service Offerings

Majesco’s Strategic Priorities report for 2021 found nearly a quarter of the products provided across all respondents were new, innovative products – reflecting an increasing focus on bringing new products and services to market to meet new risks, behaviors and changing customer demands.

Value-added services comprised a significant portion of these new products at 82% — highlighting how insurers are expanding their product offerings to meet customer needs and demands. While these value-added services were seen as low hanging fruit in the past, this shift reflects the rapid changes we’re seeing across the industry, where the competitive landscape continues to grow as insurers evolve to meet the needs of customers in this new normal.

One area we’re seeing growing rapidly is the voluntary benefits market. In light of the pandemic, employers are taking stock of their workforce, evaluating their current benefit structures to ensure they make the most of their benefit dollars while offering the best value to their employees. Voluntary benefits are increasingly important for employers to offer in the both the fight for and retention of talent.

With more employers rolling out voluntary benefits programs, including short-term disability, the opportunity to provide a value added service like absence management and have it integrated with the disability insurance offering has never been stronger for insurance companies.

Federal Paid Family and Medical Leave’s Potential Impact on the Market

President Biden’s administration recently revealed its American Families Plan [3], which includes a proposal for a federal Paid Family and Medical Leave program. While there are still many significant hurdles for this to clear before it becomes law, the impact of such a program on absence management is tremendous.

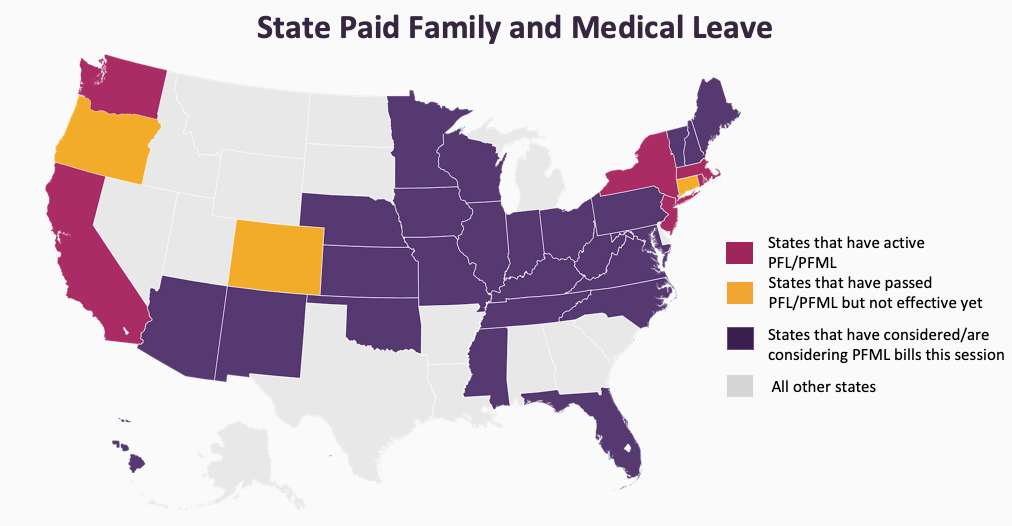

Details on the proposed program are relatively sparse, but it’s likely that a federal paid leave program would not align exactly with the benefits available in the states that currently offer Paid Family and Medical Leave programs. This would mean the state laws would likely remain in effect, and employees would have to receive benefits under whichever law was more generous in the specific circumstance, adding additional administrative complexity to managing employee leaves of absence.

Currently, calculating the benefit amount an employee is required to receive is different across the various state PFL/PFML programs. With a federal paid program layered on top, with its own calculation method, there would need to be adjustments and offsets from the federal and state payments. Include the varying eligibility rules in the above examples, and the administration will be incredibly cumbersome and require sophisticated technology to manage any real volume of claims.

The complexity of this cannot be understated and the need for a robust solution has never been greater!

State Paid Family and Medical Leave Programs to Be Rolled Out in the Meantime

If a federal program does, in fact, pass, it wouldn’t be rolled out overnight. Biden proposed that the federal program be phased in over a 10-year period, and by year 10, it would guarantee 12 weeks of paid parental, family illness, personal illness or safety-related leave. Beginning in the first year, workers would also receive three days of bereavement leave annually.[4]

According to DMEC, the outsourcing of federal FMLA has increased at an average annual rate of 5% since 2014, with larger employers also opting to outsource paid leaves.[5] Even without a federal paid leave program, the customer demand for outsourced absence management is likely to grow with the additional state Paid Family and Medical Leave programs set to be rolled out in the next three years: Connecticut in 2022, Oregon in 2023 and Colorado in 2024.

The inevitable increases in the complexity of the leave landscape over the next few years will drive more employers to look to insurance companies and TPAs to manage the administration of employee leaves for them – creating an opportunity to deepen the relationship and provide additional value.

The market demand and growth in voluntary benefits will only grow, as Millennials and Gen Z strengthen their dominance in the market. The pandemic brought to light the real need and value of insurance from life to disability. The regulatory landscape continues to change. Together, these market changes create a “perfect storm” of opportunity for growth, particularly for integrated disability and absence management offering.

But capturing this opportunity will require next-generation cloud insurance solution that can meet these demands with agility, innovation and speed.

Are you looking to roll out an IDAM offering to your customers? We are working with many leading insurers today who are capturing this opportunity! Reach out to us today to see how we can help you!

[1] 2021 Insurance Outlook: Accelerating recovery from the pandemic while pivoting to thrive, Gary Shaw and Neal Baumann, Deloitte, Dec. 2020 [2] Charts: Voluntary benefits on the rise, Emily Payne, BenefitsPRO, March 2021 [3] Fact Sheet: The American Families Plan, The White House, April 2021 [4] How President Biden’s Paid FMLA Proposal Would Work, Stephen Miller, SHRM, May 2021 [5] 2020 DMEC Employer Leave Management Survey, Karen English and Terri Rhodes, DMEC, March 2021

This blog originally appeared on Majesco.