By Denise Garth, Chief Strategy Officer, Majesco

January 28, 2021

It has been a year since the first cases of COVID became known, beginning an upending of the world as we knew it. As COVID hit, our strategies, priorities and plans all took on a new view, a new focus and in many cases a new urgency – through the eyes of digital engagement, for customers, employees and channels. The good news … many initiatives were still relevant. The bad news … many initiatives needed to accelerate because market assumptions and strategies substantially changed overnight.

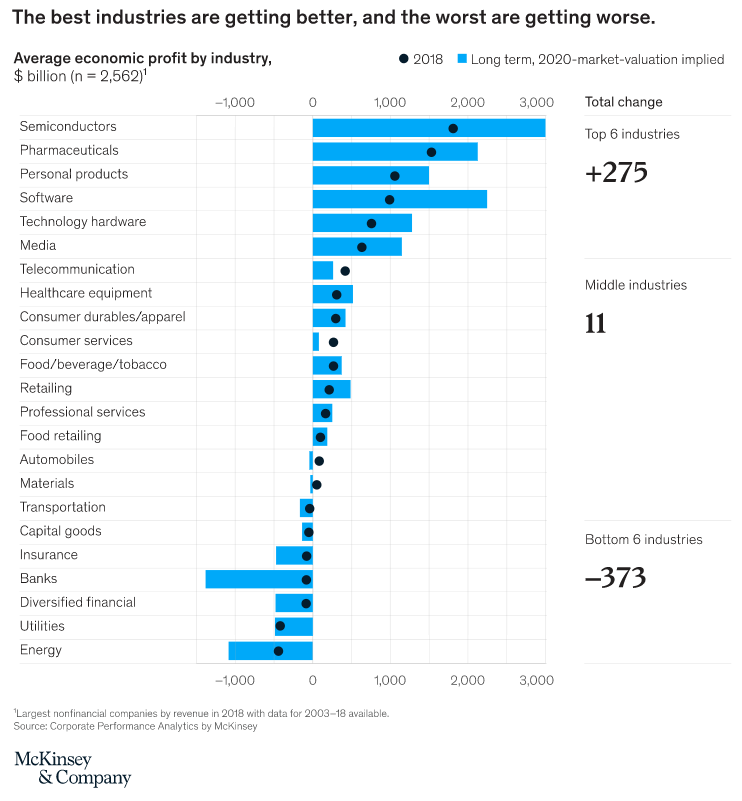

COVID impacted all industries, but some were better prepared than others because they were well down the path of digital transformation. McKinsey, in a multi-year, multi-industry research initiative, assessed economic profit by industry and identified what they term an “economic profit gap,” which became evident in 2010 and has been widening ever since.[i] Within the industries tracked, insurance is in the bottom 6 industries, showing a gap that was growing even before COVID. This is no surprise given the influx of capital to InsurTech focused on disrupting and transforming the centuries old industry.

Figure 1:

A Growing Gap Between Leaders, Follower and Laggards

Today COVID has accelerated these trends and widened the gap between the top (leaders), the middle (followers) and the bottom (laggards) – aligning to our Strategic Priorities research tracking Leaders, Followers and Laggards the past 6 years. The COVID crisis has exposed and heightened the power of future-ready, digital business models that proved more resilient, which in many cases accelerated dramatic growth. Just consider these examples:

- Streaming media vs. traditional cable

- At home cooking vs. eating out

- Curbside Pickup or Delivery vs. eating out

- Digital e-commerce vs. in-store buying

- Home delivery vs. in-store buying

Further emphasizing this, a recent report by Andreessen Horowitz noted that in the first six months of 2020, e-commerce in North America as a percentage of overall commerce increased more than in the entire decade beforehand – going from 16% in January 2020 to 27% in July 2020, after starting 2010 at only 6%!

Parts of the insurance industry also experienced this. AccuQuote, a national online life insurance agency, saw a 20%-30% uptick in life insurance applications.[ii] This aligns with a Forbes report that noted online life insurance sales increased 30%-50% for companies with speedy apps that used data/algorithm-driven underwriting, particularly for people 45 and under, the prime growth market of Millennials and Gen Z.[iii] In another Forbes article, they noted that P&C usage-based insurance (UBI) accelerated in North America as people reevaluated traditional auto insurance and opted for UBI. Prodigy, a provider of software for auto dealers that lets customers compare and buy insurance when they purchase a vehicle, said online insurance sales grew 300% in 2020, and that Millennial buyers tended to gravitate toward the UBI option.[iv]

Redefining the Future out of a Crisis

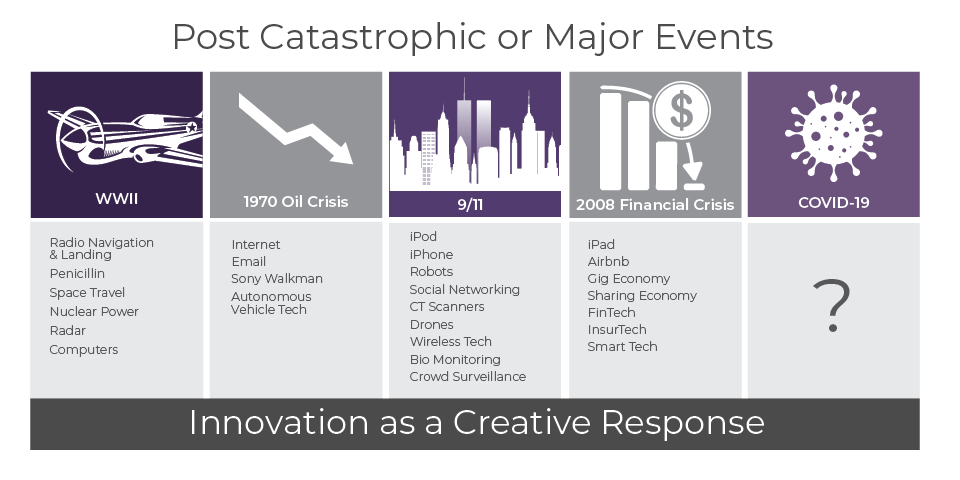

History tells a great story of opportunity and innovation by embracing disruption. Looking back at other major crises and catastrophic events, there is a strong relationship between disruption and opportunity – driven by innovation in business and technology.

Think about the Spanish Flu. It increased interest in epidemiology and established the national disease reporting system; World War II brought radar and computers; the 1970 oil crisis brought the internet and autonomous vehicle technology; 9/11 introduced social networking, wireless tech and bio monitoring; and the 2008 financial crisis gave rise to the Sharing and Gig Economies and InsurTech. Out of every one of those catastrophic or major events arose fascinating and world-shifting new businesses and technologies that helped us adapt to a rapidly changing world.

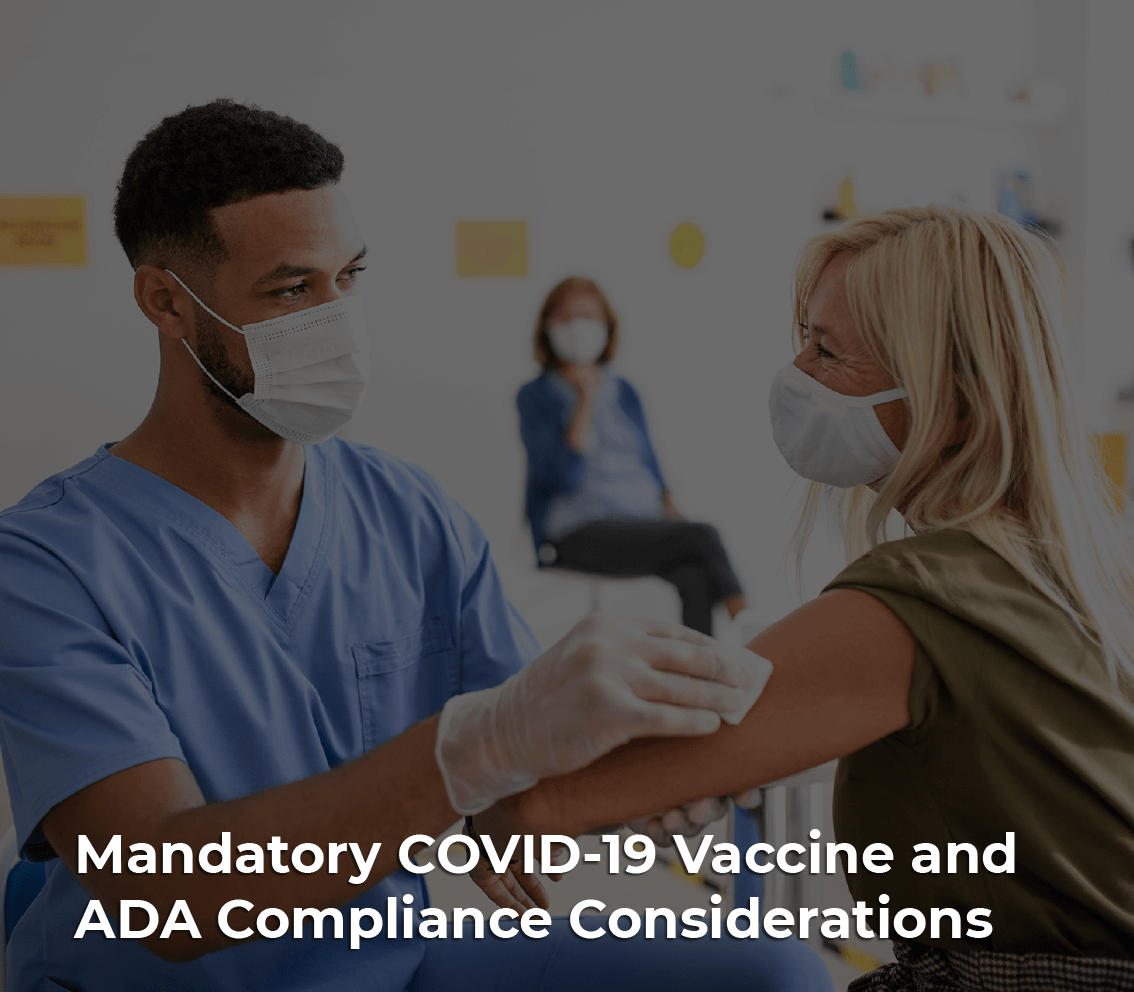

Figure 2:

Now nearly a year later after the emergence of COVID, companies – both insurers and those who are insurer customers – realize it will never go back to “normal”. Companies with resilient, future-ready digital business models were better positioned to ride the trends, embrace disruption, and thrive during the crisis, increasing their competitive advantage and establishing them as a next-gen leader.

Leaders Hit Hyper-Acceleration

Our upcoming new Strategic Priorities 2021 report, based on post-COVID insurer survey results, shows a dramatically widening gap when looking at insurers’ focus on key strategic initiatives the last year between Leaders to Laggards of 64% – representing a 20% growth in the gap from last year. Followers were “treading water” to keep even with the previous year – with a 12% gap.

Even more striking and concerning is the widening gap with Leaders in the next three years of 102% for Laggards and 28% for Followers, reflecting a 40% and nearly 10% gap growth for each! These gaps do not bode well for insurers’ ability to create economic value, grow and remain relevant with the ever-increasing pace of change and disruption.

Now nearly a year later after the emergence of COVID, companies – both insurers and their customers – realize it will never go back to “normal.” As a result, insurance companies have a unique opportunity to re-envision their future of insurance today and redefine their strategies and priorities for 2021 and beyond.

The COVID crisis along with other customer, demographic, technology and market boundary shifts are changing risk, customer behaviors and expectations – creating the demand for new risk products, value-added services and customer experiences that the insurance industry must respond and adapt to. These shifts create opportunities to make insurance better and more relevant through the innovative application of technology. Most importantly, we have the opportunity to make the change happen if we break down the silos and long-held business assumptions, embrace next generation technology and ecosystems, and more!

Just look at the accomplishments of Operation Warp Speed in the face of an “impossible” challenge! They were able to break through decades old business models and processes to deliver the impossible – delivering the first approved vaccine in less than 9 months as compared to the “traditional” long, bureaucratic, complex process that lasted 10-15 years!

Think what insurance could deliver in the same time frames – new products, customer experiences, services and much more. Instead of taking years … what can we do in weeks or months? The impossible is possible!

So how do you position yourself as a Leader, climb the economic power curve and become strong innovators?

Know where you are in the Knowing-Doing Gaps from our Strategic Priorities research that define Leaders who are accelerating digital transformation with resilient digital business models. Then rethink and reprioritize your strategies and priorities to take advantage of the shift and opportunities unfolding. And most importantly, execute on these priorities with a sense of focus and urgency.

This year’s Strategic Priorities report is more important than ever for insurers to assess where they stand and how they will respond, because “business as usual” is no longer a strategy in this time of dramatic change and pressure.

It is time for bold moves.

Finding the right balance between optimizing today’s business and boldly creating tomorrow’s business is more important than ever. Are you ready to strike that balance and rise as one of the post-crisis leaders?

To gain further insight on the upcoming report, view the webinar, Strategic Priorities 2021: The Insurance Industry Shift Hits Hyper-Acceleration for Digital Business Models, that shared details from the report.

[i] Bradley, Chris, et al., “The great acceleration,” McKinsey & Company, July 14, 2020, https://www.mckinsey.com/business-functions/strategy-and-corporate-finance/our-insights/the-great-acceleration [ii] Danise, Amy, “How Life Insurance Shopping Has Changed During The Pandemic,” Forbes, August 9, 2020, https://www.forbes.com/advisor/life-insurance/buying-during-pandemic/ [iii] Danise, Amy, “Consumers Panic Shopping For Life Insurance In The Face Of Coronavirus,” Forbes, March 12, 2020, https://www.forbes.com/sites/advisor/2020/03/12/consumers-panic-shopping-for-life-insurance-in-the-face-of-coronavirus/#351a4a826a6f [iv] Garsten, Ed, “Covid Sparks Spike In Usage-Based Car Insurance,” Forbes, December 7, 2020, https://www.forbes.com/sites/edgarsten/2020/12/07/covid-sparks-spike-in-usage-based-insurance/?sh=4f3ae7454ed0

About Denise

Denise Garth is Senior Vice President Strategic Marketing responsible for leading marketing, industry relations and innovation in support of Majesco’s client centric strategy, working closely with Majesco customers, partners and the industry.

This blog originally appeared on Majesco