By Leo Corcoran, CEO

February 25th, 2020

The Internet of Things (IoT) refers to billions of physical devices that are connected to the internet via sensors, collecting and sharing data. It provides a common platform and a common language that has been integrated into our daily lives without us fully understanding what it is, how it works, and when it got there. Almost every device we own now contains sensors. These sensors enable anything from a phone to an irrigation system, a fridge to a self-driving car into part of the IoT. It is, in fact, one of the most important components of digital transformation across all industries.

We use smart devices in practically every area of our personal and work lives, and the insurance industry has been adapting to the shifting digital landscape. The digital data revolution has created more opportunities for information collection and sharing, as well as increased competition based on data-driven insights.

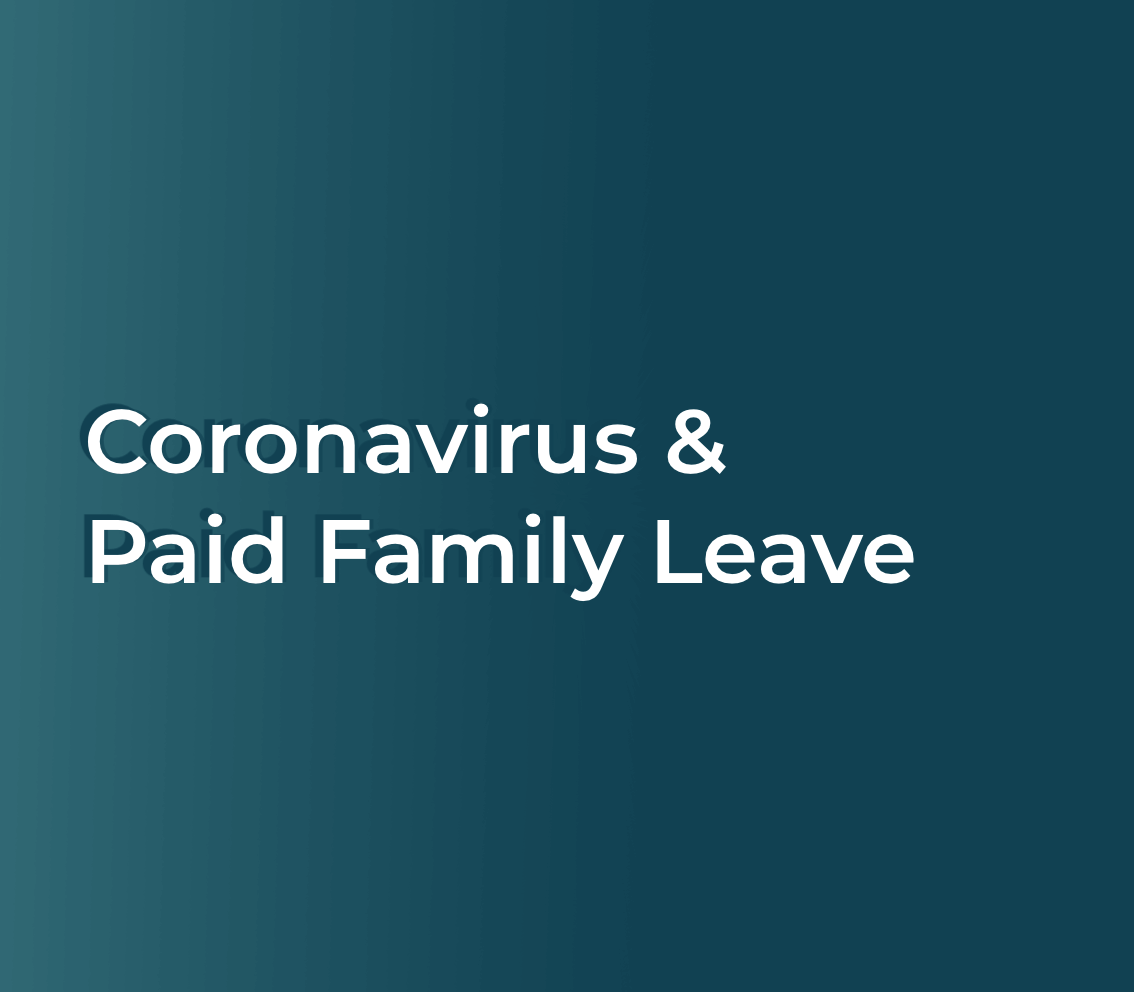

Networked devices now outnumber people and are an important component of the Internet of Things. It is estimated that by 2025 we will own over 50 billion network devices.

Graph: Mckinsey & Company

Graph: Mckinsey & Company

IoT in the Insurance Industry

As we are all well aware, technology is disrupting the traditional insurance industry; the IoT will significantly or completely change it. As customers use technology in their everyday lives they expect their insurance providers to do so as well. According to Accenture, 46% of consumers say they’d pay more for personalized, real-time services, and would share more personal data to get it. Only 15% of customers said they were satisfied with their insurer’s digital experience in 2018 according to Forbes.

So far, insurers have mainly used IoT capabilities to aid interactions with customers and to accelerate and simplify underwriting and claims processing. Increasingly, however, new IoT-based service and business models are emerging that are highly attractive to insurers.

Filling out paperwork is becoming a thing of the past as customers can now submit claims via mobile apps by taking a few pictures or even through real-time updates via video call. IoT can significantly improve the insurance customer experience. Higher customer satisfaction, driven by improved service and faster processing times, increases profit through better customer retention.

IoT technologies enable insurance carriers to determine risks more precisely, and it also helps to cut costs. Carriers can remove significant cost across the value chain, further increasing customer lifetime value, while automation can reduce the cost of a claims journey by as much as 30%.

Digital technology and the data and analysis available gives insurers the opportunity to know their customers better. This enables them to underwrite more accurately and better identify fraudulent claims.

IoT Increases Health and Prevention

With over 50 billion devices expected by 2025, the health and wellness industry will be worth an estimated $61 billion in five years.

Health insurance is one of the most important areas where connected devices will drive positive transformation for all parties involved. This will be driven by the ability to collect real-time health conditions and change data. It is predicted that more than 80 million smartwatches, over 22 million sports watches, almost 64 million wristbands, plus millions of other monitoring units will be sold by 2021. Smart devices that track condition monitoring can be used to track health and adjust policies based on risks associated with lifestyle.

In 2014, Benson Hougland explained how the IoT helped to save his life during a TEDx talk. Hougland’s smart bracelet woke him up in the middle of the night with an intense vibration, his breathing was erratic and his phone advised him that his blood pressure had gone up and to take two aspirin right away. A diagnostic of his vital report was automatically sent to his medical provider where a doctor evaluated his situation and electronically sent an EMT to his house as he needed to be seen in the hospital right away. Hougland was alerted by text that the EMT was on its way and he was put under observation. It turns out that Houghland was suffering a heart attack and as a result of things being able to talk to other things, he received the treatment that he needed just in the nick of time; all because of the IoT.

Wearable Fitness Trackers in the Workplace

Employers and insurance carriers are, in a way, working together to track employee activity levels throughout the day. It’s becoming more popular that employers are offering health tracking devices made by Fitbit, Apple, and Garmin to their employees. Usually, there are incentives in place, like a cash bonus for completing a target amount of steps per day/week, reduced premiums or reimbursements for copayments and deductibles.

Health trackers are becoming an increasingly valuable source of workforce health intelligence for employers and insurance carriers. These devices provide real-time, relevant information when needed. Having healthy workers often means employers pay lower premiums for their employees’ health insurance — a huge financial incentive for many businesses. Combining technology with workplace wellness not only creates healthier employees but also creates a stronger sense of camaraderie, happiness, and engagement, and overall positively impacts employee retention.

What are the IoT Benefits for Insurance Providers?

1. Personalization: Data collected from connected customers helps insurers to create a more personal touch through customization, which the insurance industry has been lacking.

2. Reduce Claims Assessment: Real-time access to data allows insurers to capture information about claims incident severity, the cause, and the exact time it happened.

3. Loss Prevention: Insurers can positively affect claims frequency and severity.

4. Reduce Costs: Automation can cut the cost of the claims process by as much as 30%.

5. More Tailored Products: With constant data updates, products can be customized to suit customers needs.

6. Improved Customer Experience: Data and analytics can be easily transferred between insurers and employers.

What about Data Privacy?

It is important to note that data and privacy can be an issue with the IoT, just like it can be with all aspects of the internet. Employers and insurers will need to notify employees/consumers of what personal data is being collected and why. They should also inform them of the legal basis for processing the relevant data, who it is shared with, how it is kept secure, and how long it will be retained for.

It goes without saying that connected devices will enhance the profitability of insurers and with so many potential benefits, connected devices are sure to be an integral part of insurance offerings in the future.

To learn more about ClaimVantage and how it is improving the insurance claim management experience with its cloud-based software, read our company overview.